You are an entrepreneur who surely wants your own franchise insurance business to excel, so it’s important to understand the pros and cons of different business models. The variations in each strategy can make or break your results, but there are ways you can make an informed investment decision.

Working with a franchise partner that already has a reputable business model will help you achieve long-term profitability. Let’s take a look at the different types of franchise business models, why they are important for reaching your goals, and how to determine which strategy is best for you.

Why Franchise Business Models Matter

Before we delve into the intricacies of optimal franchise business models, let’s talk about why understanding the structure of each option is paramount for your future success. Think of a business model as the foundation for the rest of your entrepreneurial journey: your business model sets the stage for everything and anything that happens with your franchise.

Each of the strategies below comes with its unique characteristics and suitability. When you know how each model works, you can look for one that aligns best with the insurance products you offer and your other professional aspirations.

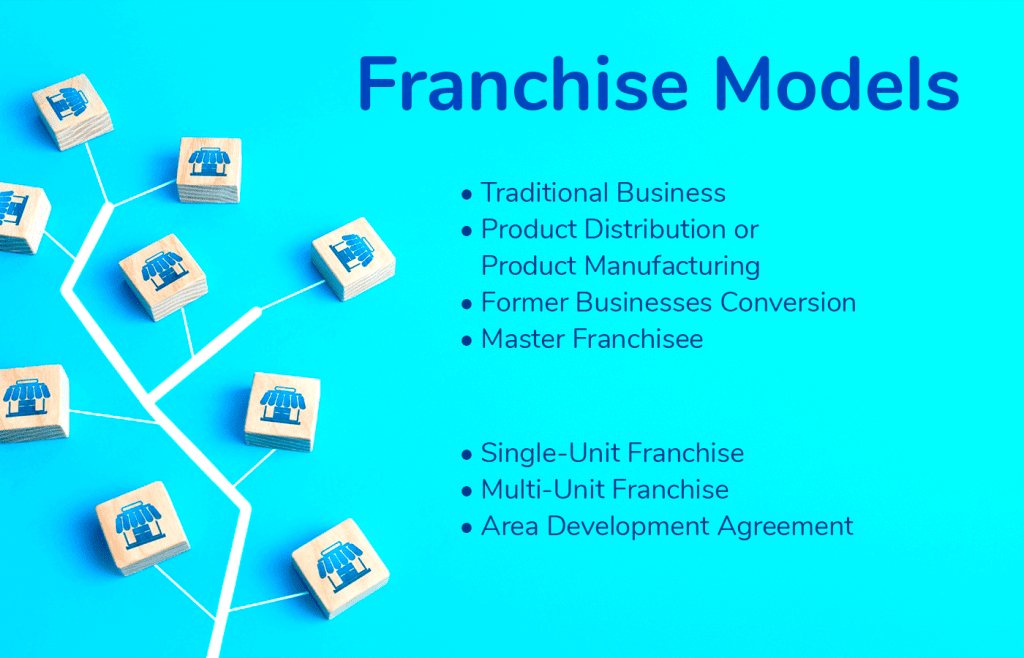

Types of Business Franchise Models

There are four common business models used in today’s franchise landscape. Let’s take a look at each of the four strategies and their unique advantages.

Traditional Business Format

Traditional business format strategies are used when a franchisor grants you the right to operate a branch under their brand. Think of your favorite fast-food chain or retail store – which are often traditional business-format franchises – and how they work similarly in the insurance sector.

When you operate within this traditional framework, you benefit from a proven system, brand recognition, and ongoing support. Thus, you reduce the risks of starting an organization on your own because this method is “tried and tested.”

Product Distribution or Product Manufacturing

Product distribution and product manufacturing operate just as their names indicate: these systems help you distribute or manufacture a specific product. Product distribution and product manufacturing are ideal if you are passionate about a particular niche. When you want to target a specific demographic and set of customer needs, you have the processes that help you showcase and sell the products you believe in.

In the insurance sector, you need a diverse portfolio of products to sustain profitability, and these methods emphasize your offerings as the focal point of your revenue.

Former Businesses Conversion

If you want to convert an existing profitable company into a franchise, make sure you work with a franchisor with a solid former business conversation model. If you already have an organization you want to scale without starting anew, conversion franchising is the way to go.

Using this strategy involves converting your existing brand into a franchise. This system can be appealing because you can leverage your current profits and expand your reach.

Master Franchisee

The master franchisee acts as a mini-franchisor for a specific geographic area, with the right to sub-franchise within that region. As the master franchisee, you act as an intermediary between the franchisor and other individual franchisees.

If you want to run your own franchise empire within a designated territory, this is the model to look for. You get the best of both worlds – profitability from multiple branches and growing to scale.

Success with Unique Franchise Models

Now, let’s explore other business strategies that are even more unique. In today’s diverse franchising landscape, you’re not confined to a one-size-fits-all approach. Instead, you have the flexibility to choose agreements that align precisely with your vision. Below are a few examples showcasing the range of options available to you and illustrate their relevance to your specific needs.

- Single-Unit Franchise: If you are passionate about a particular insurance concept, opting for a single-unit franchise agreement allows you to own and operate one branch under that brand. It’s a hands-on approach, which is perfect if you want to focus on day-to-day operations and build a strong connection with your local community.

- Multi-Unit Franchise: If you are ambitious and envision running multiple outlets of the same brand, a multi-unit franchise agreement enables you to own and operate more than one unit within a specified area. This approach is ideal if you want to scale quickly and capitalize on economies of scale

- Area Development Agreement: If you’re an entrepreneur with a broader vision and aspiring to manage a brand across an entire region, an area development agreement grants you the rights to open multiple units within a defined territory over an agreed-upon timeline. This structure is strategic when you want to play a pivotal role in establishing a brand in a specific market.

Understanding the above franchise models is crucial too because that knowledge further tailors your vision. When you can clearly see the business designs that align with your goals, you can make even more informed decisions. As you are likely eager to dive into the world of franchising with one location first, a single-unit franchise might be your perfect match. On the flip side, if you’re enthusiastic about a larger-scale operation, a multi-unit or area development agreement will better suit your ambitions.

Choosing the Best Business Model for Your Goals with Freeway Franchise

As you get started, know that Freeway Insurance is a highly compelling opportunity to partner with a reputable brand. We have a business model that helps you reach your specific goals, comprehensive training to get you there, and a diverse product portfolio – all of which are necessary for the long-term advancement of your branch.

Ready to take the next step today? Let us help you catalyze your vision into action. Freeway Insurance is committed to your growth, so reach out online or call us at (877) 822-3024 and speak with a representative and learn more.